New Auto

- Rates starting at: 4.75% APR2

- Financing up to 84 months.

- No down payment required.

Payment Saver

- Low monthly payments.

- No down payment required.

- Financing up to 72 months.

- Up to 18,000 miles a year.

Used Auto

- Rates starting at: 4.75% APR2

- Financing up to 84 months.

- No down payment required.

Auto loan payment calculator.

Enter the price of the vehicle you're looking to buy + adjust the sliders to see your potential loan payment.

.

Payment Saver Loan

Much like a lease, you only pay for what you use. Your low monthly payments cover the car's worth while you're driving it, and, at any time, you have the option to keep, sell, or trade because it's titled in your name.

Advantages over leasing:

- Refinance at any time.

- No money down required.

- Higher mileage options.

- You own the vehicle.

Have peace of mind

Protect your loan.

DEBT PROTECTION WITH LIFE PLUS3

Your safeguard against the unexpected.

Your family means everything to you. And if the unexpected happens, you don’t want an emotionally trying situation to be compounded by financial worry. That’s why there’s Debt Protection, which may cancel your loan balance or payments in case of:

- Involuntary unemployment

- Disability

- Loss of life

- Illness

- Hospitalization

*Members received $349,192.22 in benefit compensation last year.

GUARANTEED ASSET PROTECTION (GAP)4

For what your auto insurance may not cover.

If your vehicle is deemed a total loss due to an accident or stolen, there can be a significant gap between what you owe on your loan and what your auto insurance will cover. GAP may reduce or even eliminate that shortfall in the event your vehicle is a total loss. Benefits include:

- $1,000 towards your insurance deductible. (For those unexpected fender-benders)

- $2,500 down payment towards replacement vehicle5. (If car is totaled)

- Reduction or even elimination of the amount you owe on your loan that insurance does not cover.

*Members received $85,314.30 in benefit compensation last year.

MECHANICAL REPAIR COVERAGE6

Essential protection against costly repairs.

Drive with confidence, knowing we’ve got your back. A breakdown can be troubling enough without the added worry of expensive repairs. That’s why we’re pleased to bring you Mechanical Repair Coverage. Benefits include:

- Rental reimbursement.

- 24-hour emergency road-side assistance.

- Key replacement.

- Paintless dent repair.

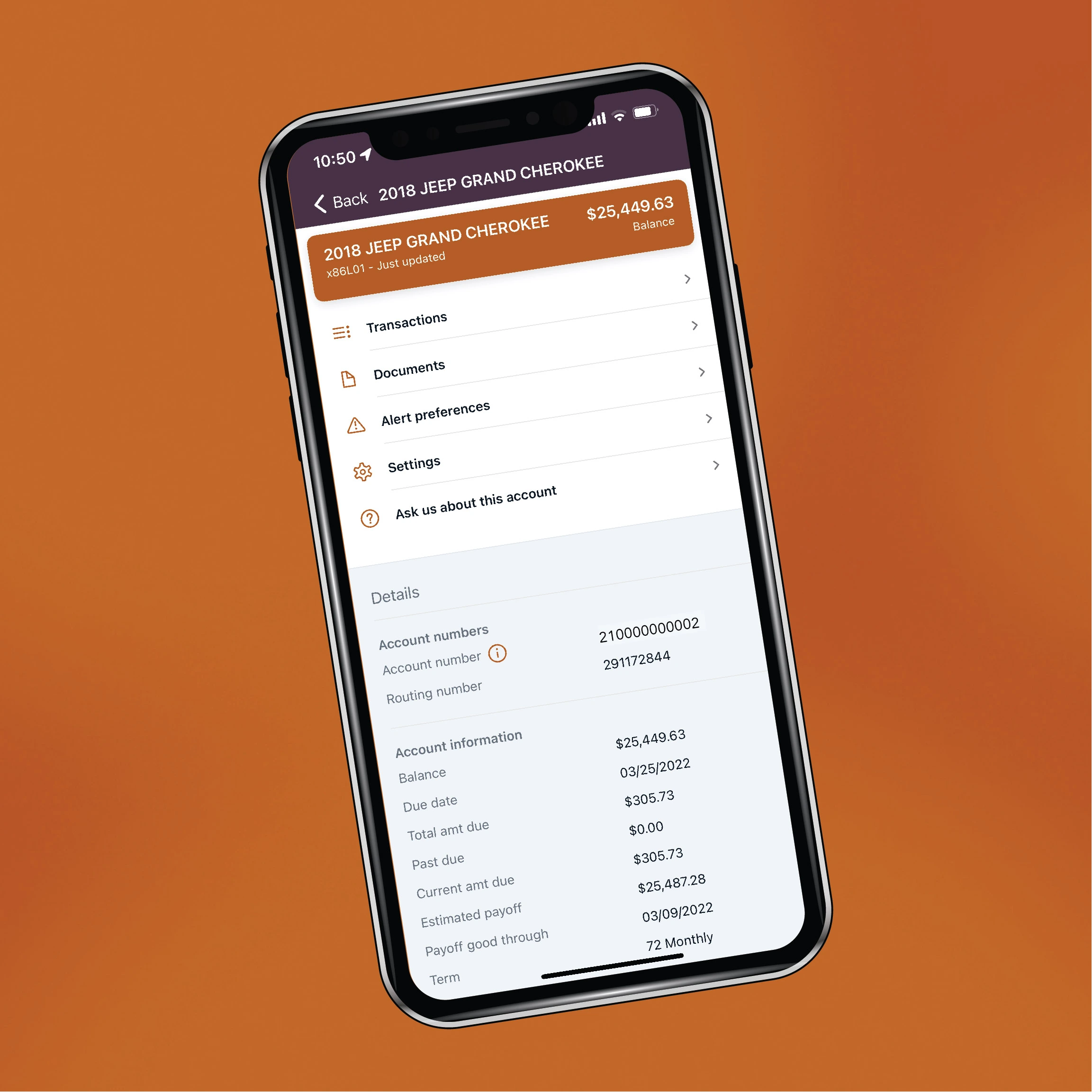

DIGITAL ACCESS

Keep tabs on your loan.

Through our digital banking platform you can:

- View your loan balance.

- Due date.

- Estimated payoff.

- Transaction history.

- Accrued interest.

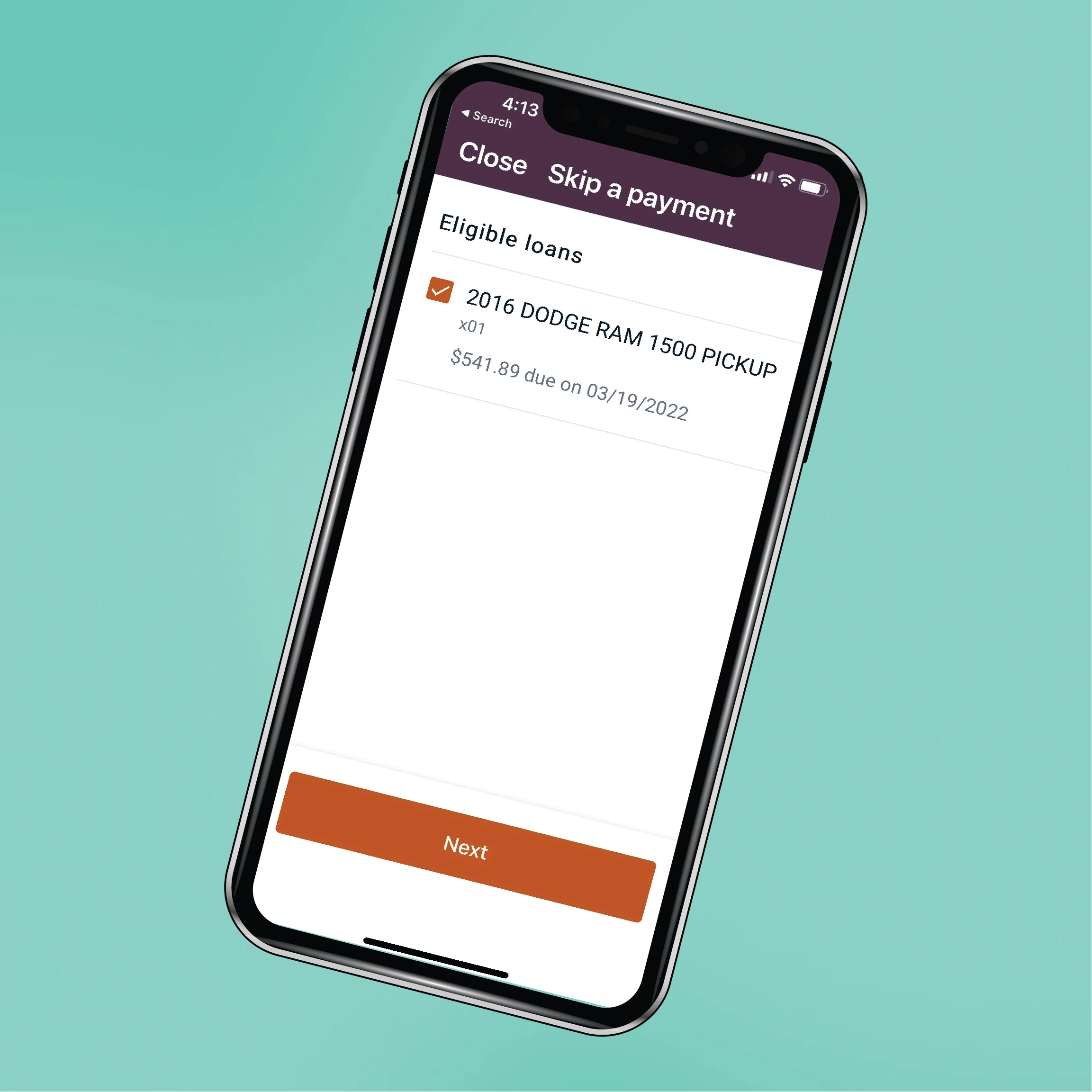

TAKE A BREAK

Skip your loan payment.

When you need a little extra cash for holiday spending or unexpected expenses, you can skip up to two monthly payments per 12 month period on eligible loans.

Questions?

We have answers.

What type of insurance is required on a loan?

"Full Coverage" insurance encompassing collision, liability, and comprehensive coverage is required on vehicles financed by Embers.

Can I add loan protection to an existing loan?

Yes! You'll just need to get in contact with your loan officer to discuss the specifics.

Can I pay my loan from an account at a different institution?

Yes! You'll just need to know your other account's information and visit our Quick Pay site. You can also complete an external transfer through digital banking.

Are there prepayment fees?

No! You can pay early or pay off your loan at any time.

Ready to apply for a car loan?

Continue your journey.

*84 month loan term for cars 2021-2025. Other restrictions and terms apply.

2. APR = Annual Percentage Rate • Rates subject to change at our discretion.

3. Your purchase of Debt Protection with Life Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions and exclusions may apply. Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Debt Protection with Life Plus. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.

4. Your purchase of MEMBERS CHOICETM Guaranteed Asset Protection (GAP), which includes deductible assistance, is optional and will not affect your loan application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

5. To receive the $2,500 down payment towards a replacement vehicle, you must finance the replacement vehicle with Embers.

6.Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. in all states except CA, where coverage is offered as insurance by Virginia Surety Company, Inc., in NH, where coverage is provided and administered by Consumer Program Administrators, Inc. dba Consumer Warranty Program Administrators, in TX, where coverage is provided and administered by Consumer Program Administrators, Inc. dba The Administrators of Consumer Programs (TX License #175), in FL and OK, where coverage is provided and administered by Automotive Warranty Services of Florida, Inc. (Florida License #60023 and Oklahoma License #44198051), and in WA, where coverage is provided by National Product Care Company and administered by Consumer Program Administrators, Inc., all located at 175 West Jackson Blvd., Chicago, Illinois 60604, 1-800-752-6265. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc. Coverage varies by state. Replacement parts may be new, used, non-OEM or remanufactured. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions of this voluntary product.