Fixed-Rate Mortgages.

10 to 30-year terms

Break down the barriers of homeownership with our mortgage products and services.

- Low down payment options.

- Unconventional property financing.

- Closing cost + down payment assistance.

- Tax + home insurance payment services.

Looking for mortgage rates?

As mortgage rates change daily, contact one of our mortgage loan officers to get the best rate information.

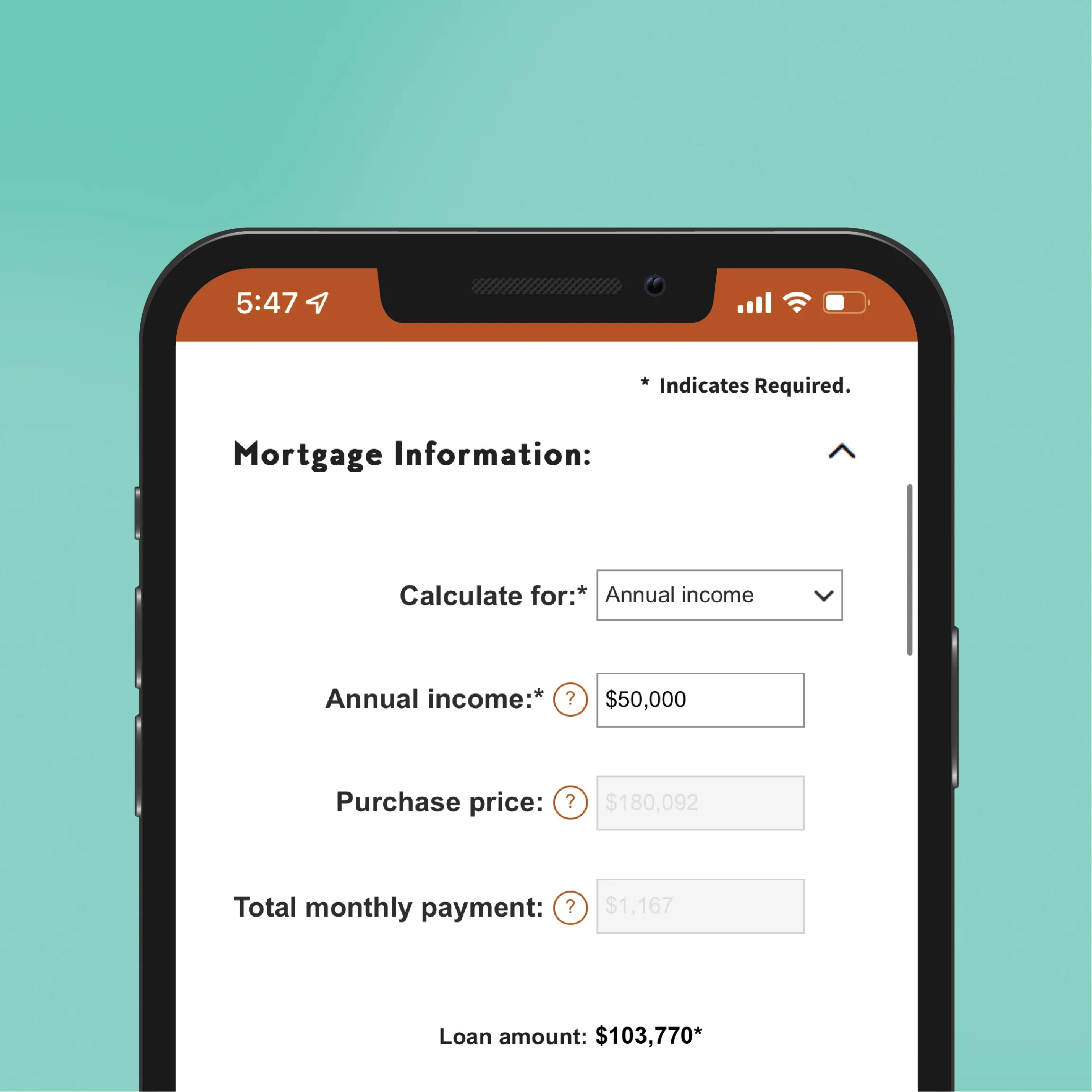

PURCHASE BUDGET CALCULATOR

How much house can you afford?

The first step in buying a house is determining your budget. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow.

Mortgage Payment Calculator

Calculate your mortgage payment.

Determine your monthly payment and generate an estimated amortization schedule. At Embers, we also offer tax and homeowners insurance services where parts of your payment are allocated towards those expenses - leaving you nothing to worry about!

HOW MUCH DO YOU NEED FOR A DOWN payment?

3% down payment options.

20% down is not a requirement to buy a home. While ideal, it's just not realistic for everyone as housing prices rise and income becomes stretched. That's why we offer products that require as little as 3% down. If you put less than 20% down, you'll need Private Mortgage Insurance - not to be confused with homeowners insurance. See this defined below!

What is PMI?

Private mortgage insurance

Private Mortgage Insurance (PMI) safeguards the home buyer and the home lender's mutually beneficial relationship. It allows the buyer to purchase a home without having a large sum of cash on hand and protects the lender if the borrower defaults on their payments. Once 22% of the purchase price balance is paid off (78% loan to value ratio), PMI is no longer required, the policy is canceled, and your monthly payment is lowered.

Freddie Mac BorrowSmartSM

Home buying assistance.

You may be eligible to receive up to $2,500 in assistance to purchase a new home. With the Freddie Mac BorrowSmartSM program, we’ll help you with funding to pay your down payment or closing costs.

Meet our Mortgage Team.

April Stropich

AVP, Mortgage LENDING MANAGER

Hello, I'm April. I am born, raised and raising my family in the great Upper Peninsula. Let’s make your goal of owning a home; a reality! If you would like to purchase a home, second home, camp or investment let’s talk on the options to make that goal a reality!! We want to assist you with all of your financing needs from your first purchase to your retirement purchase. If you see me and have questions please ask. When I'm not at Embers assisting members you will find me at the Softball/Baseball fields, ice rinks, on the lake or in the great outdoors. I have a passion for helping others reach their goals.

Magan Peterson

Senior Mortgage Loan Officer

Hey there! I’m Magan, and I’ve been helping people with home loans for over 16 years. Whether you're buying your very first home, building your dream home, or something in between, I’m here to make the process as smooth and stress-free as possible. I truly love what I do and feel lucky to be a part of such an exciting time in people’s lives. When I’m not working, you’ll usually find me spending time with my husband and our two kids, out on the golf course, or just enjoying life in the beautiful Upper Peninsula.

.png)

Hannah Anderson

Mortgage Loan Officer

Hi, I'm Hannah! I was born in Marquette and have lived in the Upper Peninsula my entire life. I enjoy getting to know our members and making sure they are set up for financial success no matter what stage of homeownership they are in. When I'm not helping members reach their financial goals, you will find me reading, baking, or spending time with my family.

Marlene Curtis

Mortgage Loan Officer

Hi, I am Marlene! I have been working as a Mortgage lender for the past 22 years. While I was not born and raised in the Upper Peninsula, I have been here for over 30 years and understand the needs of our residents to have a home to call their own. I would live nowhere else. While I am not helping people with their finances, I enjoy reading, campfires, the water, and my grandkids. This is a great place to live! So let Embers help

make it a home.

make it a home.

Questions?

We have answers.

Do I need to find a house before I apply for a mortgage?

No, most realtors prefer that home buyers are pre-approved by a financial institution prior to looking at houses to be sure they are searching in their accurate price range. By being pre-approved you shorten the length of time needed to process your mortgage loan allowing you to move into your new home sooner. In addition, sellers prefer to know that potential buyers are pre-approved when presented with an offer to purchase.

Is an escrow account required for taxes and insurance?

In certain circumstances an escrow account may be required. Escrow accounts are highly recommended to our members in order to ensure timely payments of taxes and hazard insurance. With an escrow account, we handle the payment of taxes and insurance for you, allowing you to have one less thing to worry about paying on time. Should you have a question about an escrow account, you may contact your loan officer or stop by any of our offices.

Is there a penalty to pay off my mortgage early?

No, we do not have a pre-payment penalty or early termination fee associated with any of our mortgage products.

What documents do I need to apply for a mortgage?

- One month's worth of pay stubs.

- W-2s from the last two years.

- Tax returns from the last two years (if self-employed).

- Your two latest bank statements.

How long does the mortgage process take?

When purchasing a home, the mortgage process generally takes 30 days. Refinances are generally processed in 45 days

Can I pay extra in addition to my regular payment?

Yes, you can pay extra in addition to your regular payment at any time which results in a shortened loan term. This extra amount will be applied as a principal only payment, reducing your current balance, but will not affect your next payment due date.