Cash back. No confusing point system.

Cash rewards that are deposited into your account quarterly.

CASH BACK

Earn 2% on Gas.

Get rewarded for all your gas purchases at your favorite stations including:

- Circle K

- Meijer

- BP

- Kwik Trip

- And all other gas stations.

CASH BACK

Earn 1% on Other Purchases.

You'll be rewarded for the lifestyle you live. Earn cash back on:

- Groceries

- Restaurants

- Breweries + Bars

- Subscriptions

- And all other purchases.

PAY ON TIME AND THERE'S

No Fees1

Starting at just 12.40%

Low interest rates.

Big rewards, small rates. The Embers Credit card starts at just 12.40% APR.‡ See how that stacks up against other credit cards:

- Capital One: 19.99%2

- Discover: 16.99%4

- American Express: 17.99%5

- Venmo: 20.24%6

- Chime: 14.49%7

- Apple: 15.99%8

ADDITIONAL PERKS

Card Benefits

Powered by Mastercard®, the Embers Credit Card is equipped with these perks†:

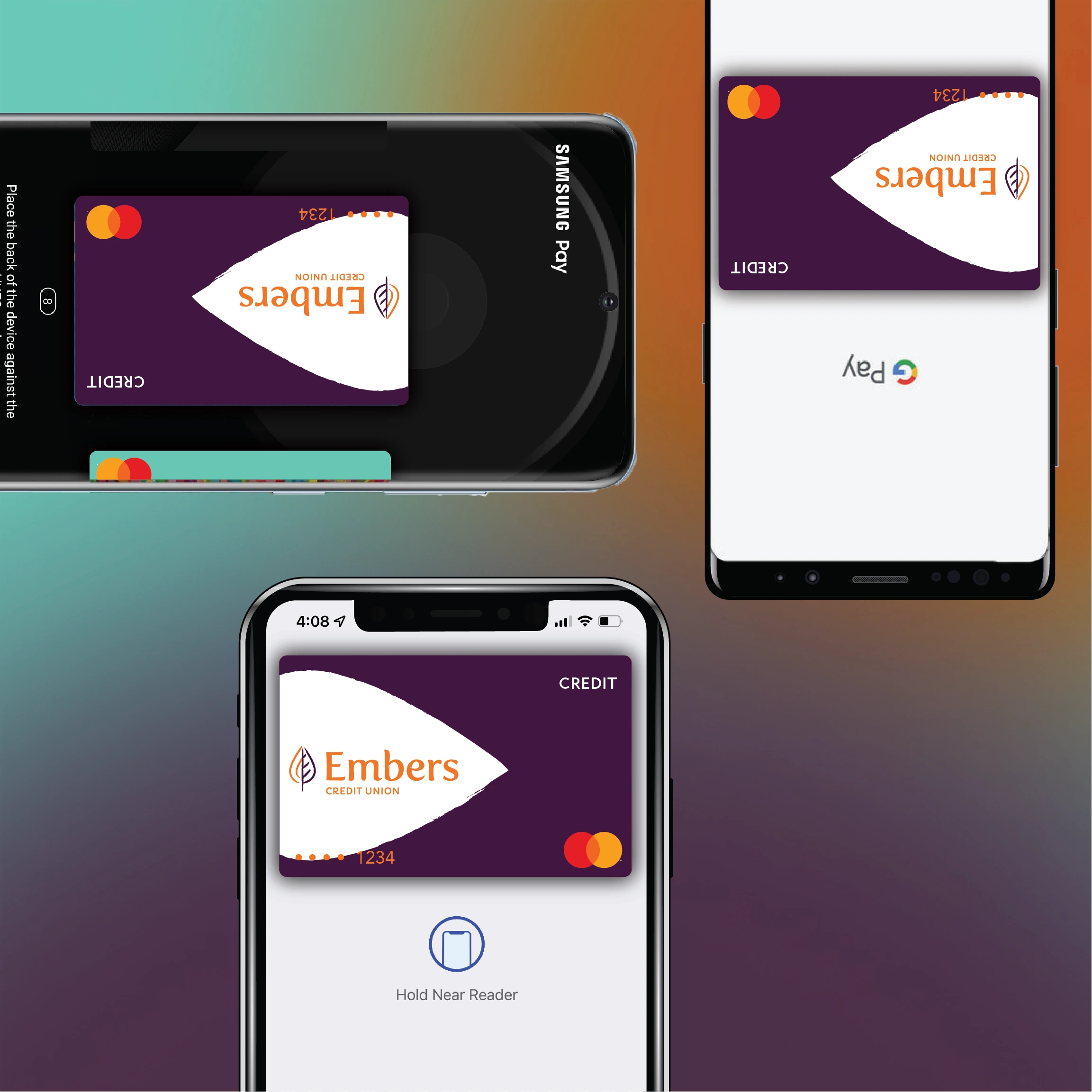

TAP TO PAY

Digital wallet ready.

The Embers Credit Card can be added to mobile payment platforms including Apple Pay™, Samsung Pay™, and Google Pay™. Look for the contactless payment icon below to see where digital payment is available.

.

How can we help?

FREAQUENTLY ASKED QUESTIONS

What do I do if I lose my credit card?

You can lock your card within digital banking to shield unauthorized purchases, or even after hours, you can call our number, (906) 228-7080, or message us via digital banking and a team member can assist you.

Who do I notify when I'm traveling?

Give us a call at (906) 228-7080 or start a conversation in digital banking, and a Team Member will make your card trip-ready.

Rather open a credit card in person?

Continue your journey.

1. A $25 fee will be assessed if payment is not made within the grace period of the due date.

2. Data pulled on 07/27/23 from Capital One: https://www.capitalone.com/credit-cards/compare/

3. You grant us a security interest in all individual and joint share and/or deposit accounts you have with us now and in the future to secure your credit card account. Shares and deposits in an IRA or any other account that would lose special tax treatment under state or federal law if given as security are not subject to the security interest you have given in your shares and deposits. You may withdraw these other shares unless you are in default. When you are in default, you authorize us to apply the balance in these accounts to any amounts due. For example, if you have an unpaid credit card balance, you agree we may use funds in your account(s) to pay any or all of the unpaid balance.

By agreeing or otherwise authenticating above, you are affirmatively agreeing that you are aware that granting a security interest is a condition for the credit card and you intend to grant a security agreement.

- You promise that everything you have stated in this application is correct to the best of your knowledge. If there are any important changes you will notify us in writing immediately. You authorize the Credit Union to obtain credit reports in connection with this application for credit and for any update, increase, renewal, extension, or collection of the credit received and for other accounts, products, or services we may offer you or for which you may qualify. You understand that the Credit Union will rely on the information in this application and your credit report to make its decision. If you request, the Credit Union will tell you the name and address of any credit bureau from which it received a credit report on you. It is a crime to willfully and deliberately provide incomplete or incorrect information in this application.

- If you are applying for a credit card, you understand that the use of your card will constitute acknowledgment of receipt and agreement to the terms of the Consumer Credit Card Agreement and Disclosure.

4. Date pulled on 07/27/23 from Discover: https://www.discover.com/credit-cards/0-percent-intro-apr-credit-cards/?ICMPGN=SUBNAV_CCF_LOW_INTEREST

5. Data pulled on 07/27/23 from American Express:https://www.americanexpress.com/us/credit-cards/?inav=menu_cards_pc_viewallcards&category=low-interest

6. Data pulled on 07/27/23 from Venmo: https://www.synchronybankterms.com/gecrbterms/html/VenmoApplyTerms_combo.htm

7. Data pulled on 07/27/23 from Chime: https://www.chime.com/blog/what-is-apr-on-a-credit-card/

8. Data pulled on 07/27/23 from Apple: https://www.goldmansachs.com/terms-and-conditions/Apple-Card-Customer-Agreement.pdf

†. Purchase Assurance: You must purchase the new item entirely with your covered card and/or accumulated points from your covered card for yourself or to give as a gift. Cell Phone Protection: You must charge your monthly eligible cellular wireless telephone bill to your covered card. You are eligible for coverage the first day of the calendar month following the payment of your eligible cellular wireless telephone bill to your covered card. If you pay an eligible cellular wireless telephone bill with your covered card and fail to pay a subsequent bill to your covered card in a particular month, your coverage period changes as follows: 1. Your coverage is suspended beginning the first day of the calendar month following the month of nonpayment to your covered card; and 2. Your coverage resumes on the first day of the calendar month following the date of any future payment of your eligible cellular wireless telephone bill with your covered card. Trip Cancelation: You must charge the full amount of a Covered Trip to your Covered Card or in combination with your Covered Card and accumulated points on your Eligible Account or redeemable certificates, vouchers, coupons, or discounts awarded from frequent flyer program or similar program. MasterRental: You must initiate and then pay for the entire rental agreement (tax, gasoline, and airport fees are not considered rental charges) with your covered card and/or the accumulated points from your covered card at the time the vehicle is returned. If a rental company promotion/discount of any kind is initially applied toward payment of the rental vehicle, at least one (1) full day of rental must be billed to your covered card. You must decline the optional collision/damage waiver (or similar coverage) offered by the rental company. You must rent the vehicle in your own name and sign the rental agreement. Your rental agreement must be for a rental period of no more than fifteen (15) consecutive days. Rental periods that exceed or are intended to exceed fifteen (15) consecutive days are not covered.

‡. APR = Annual Percentage Rate and is current as of 10/01/2024. Variable APR determined by adding a margin to the Prime rate and ranges from 12.40% – 19.40%. Margin is based on individual creditworthiness and may change in future. Credit card rates, terms, conditions and instant approval based on credit qualifications, account relationship and approval. Rates, terms, and conditions are subject to change. Membership eligibility required.